Cash App scams: Everything you need to know

For millions of people in the UK and the US, Cash App has been an invaluable service. In a post-Covid world where people have been getting used to cashless environments, Cash App has thrived. With this rise in use, however, comes the equal prevalence of Cash App scams. Here’s how to recognize a scam.

Contents

Is Cash App safe?

Nothing attracts scammers like a financial app. As such, Cash App’s users are often targeted with various online tricks to persuade them to give up their money. However, the app has several safety features such as encryption and fraud protection to help prevent users from being scammed. Let’s check out some of Cash App’s safety features next.

Cash App’s safety features

Cash App offers a few particular safety features to protect its users.

- Security locks. Protect your payments with biometric verification (Touch ID, Face ID) and PINs.

- Encryption. Use Cash App privately — all your data is fully encrypted.

- Card block. Disable your card remotely if you ever lose it.

- Notifications. Get notified about suspicious activity via push notifications, text, or email.

- Fraud protection. Don’t get caught! Cash App measures protect you from unauthorized charges.

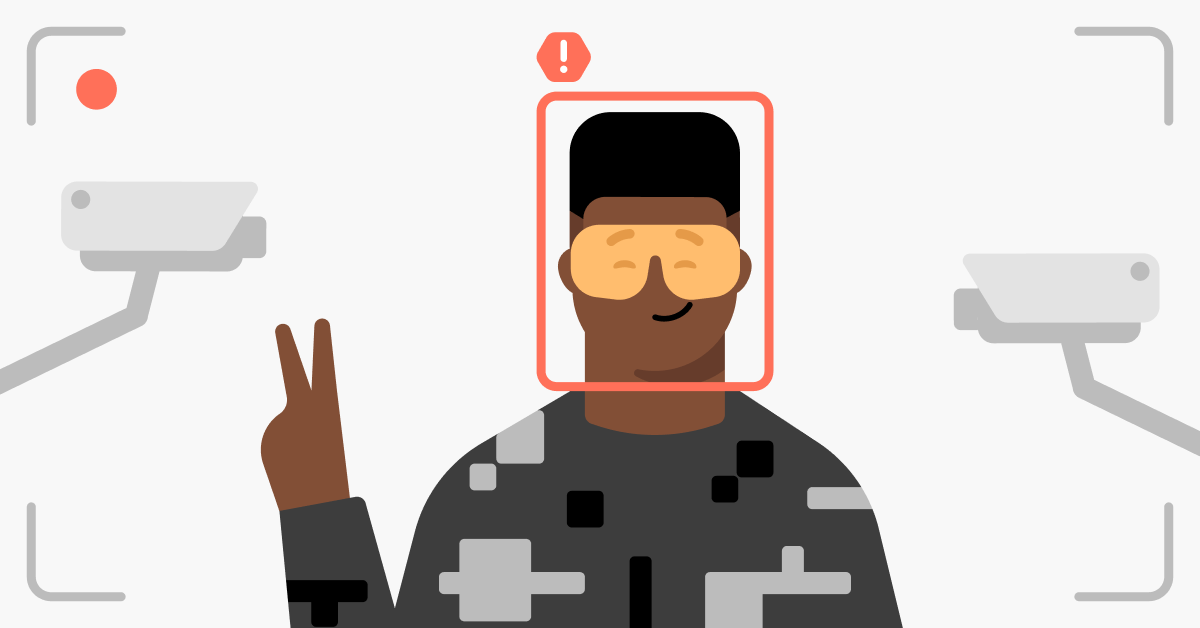

How to recognize Cash App scammers

Cash App – and any cash transferring app for that matter – all suffer from the same issue of scammers and thieves targeting their users on a much larger scale than any other industry. While the finest and most up-to-date cybersecurity software available can protect you, it won’t help if you fall for a well-crafted trick.

Don’t worry, we’ll show you how to spot a scam spot a scam so you can hopefully avoid some obvious pitfalls. Scammers rely on socially engineered methods to trick you into thinking a bogus service or website is legitimate. Once you’ve fallen for their ruse, the criminal will abscond with your credentials and block you across all communication platforms.

In general, when it comes to Cash App scams, a few telltale signs immediately reveal that something may be wrong. Here are signs of a potential scam:

- If a supposed employee from the app personally gets in touch regarding issues with your account. Apps rarely have reasons to contact customers individually. Moreover, Cash App knows that if its support team will start calling people, the likelihood of users getting scammed will increase. If someone working for Cash App says they need to get in touch, you can send the email or message straight to the trash.

- Does a deal look too good to be true? It usually is. Scammers will try everything to entice you into believing a deal is legitimate. They’ll even send you money in advance. So if you spot insanely cheap prices on otherwise expensive hardware, think twice before going ahead with the purchase.

- Do they ask you to pay a deposit? If a seller is trying to get you to pay to reserve an item, you’re already in the thralls of a scam. Once the deposit has been paid, don’t be surprised if you suddenly can’t get in touch with the seller.

Common Cash App scams

Here are some of the most common Cash App scams that you might encounter online.

Cryptocurrency scams

Since 2018, Cash App has allowed Bitcoin to be bought and sold on the app. While the move to include Bitcoin helps Cash App stay relevant in the online financial space, it also opens the door for scammers. Cash App Bitcoin scams could range from asking for capital on a large amount of Bitcoin with the promise of a sizable return or someone offering to enhance your current Bitcoin value. You need to be aware that you might not see your cryptocurrency return.

Fake Covid schemes

The global pandemic kickstarted a wave of new Covid-19 scams. With much of the world still in the throes of the virus, hackers with insidious methods have tried to take advantage of the panic. Anything Covid related can be weaponized as a scam — it could be something as simple as an offer of cash for getting vaccinated or asking for cash for an “experimental” new cure. The moment you’re asked to share payment or account information, you know it’s a scam.

Cash flipping

In what would seem to be an obvious scam looking in from the outside, cash flipping is a lot more insidious in nature. These kinds of scams always target those who are desperate for cash, using socially engineered tactics to entice people into risking a few bucks for the chance of a large return. Cash App flip scams will ask for you to send anywhere between $100-$1,000 and offer back double or triple the amount. Scammers try to convince victims by showcasing all the other users that are also in on the scheme.

Fake #CashAppFriday scams

For a while, on Fridays, Cash App had giveaways in which users could win cash prizes. Hackers quickly took advantage of this opportunity to create their own fake #CashAppFriday scams. Some scammers even go as far as to create fake raffles. For a chance to win, all users need to do is send the organizers a small cash sum or their credentials. These scams remain popular despite the fact that the real Cash App Fridays have ended.

Posing as Cash App support

As we’ve already mentioned, many common Cash App scams involve someone posing as a customer support agent contacting you directly. It helps lull users into a false sense of security. Do not trust anyone asking you about your balance or PIN. This may sound too basic to be a Cash App scam, but trust us, many people have already fallen for it.

If anyone contacts you out of the blue from a company you’re using, take a moment, find the company’s contacts online, and write to them yourself.

Social Security number scam

While your Social Security number is private, sometimes you need to share it with an employer or a financial institution such as a bank. But the key point here is that you come to the service. If someone asks for your Social Security number, it’s likely a scam.

Giveaways

Giveaways is a common scam technique not only for Cash App. Fraudsters know people can’t resist a good bargain, so they’ll offer anything you can think of at a massive discount. But have you heard the saying that free cheese can only be in a mousetrap? Unfortunately, many haven’t.

Moreover, users sometimes misunderstand what Cash App does, or rather, what it doesn’t do. If you send someone money for a smartphone they’re selling at a discount, Cash App can’t refund you if your deal goes south. It is not a marketplace, just a platform to send someone money.

Random deposit

If you use Cash App, you may one day get some free money. Don’t get too excited. It’s probably another Cash App scam. After you get the money, the sender will try to explain what a big misunderstanding all of this is. They just made a mistake and need you to send the money back. You’re a decent person, so you do.

But what really happens is you send them your money, while they call their bank and dispute the payment on their end. They get the refund from the bank and walk away with your money.

How to protect yourself from Cash App scams

When it comes to online security, knowledge is power. If you recognize all the call signs of a scam, then you’ll know exactly how to avoid them. Even if you feel something’s a little off, trusting your gut may be well worth it. When it comes to making an expensive purchase, it’s best to verify the item is real. Don’t immediately send funds over, always think twice and do your research before committing to a money transfer. Remember, it’s up to you to stay on your toes and not fall for scammers’ tricks.

Due to how prevalent Cash App has become, don’t be surprised if you encounter scams across different platforms. Cash App scams on Facebook and Instagram are a common sight. Since 2020, Cash App has been approved for usage for 13- to 18-year-olds. Younger users who spend hours on social media may be bombarded with Cash App scams — make sure kids in your household are aware of the risks.

If you ever fall victim to a scam, make sure you record every detail of the criminal and report them to Cash App’s customer service, Cash Support. While you might not get your money back, at least you can potentially stop future scams.

Want to read more like this?

Get the latest news and tips from NordVPN.